Alimony Calculator in Texas: A Guide To Spousal Maintenance

Divorce is a complex and emotionally challenging process, often accompanied by the intricate web of financial considerations. Among these, alimony, also known as spousal maintenance, plays a crucial role in determining the financial responsibilities between ex-spouses. If you’re navigating the waters of family law in Texas or simply curious about how alimony is calculated, this comprehensive guide is your compass.All US courts utilize a calculator to determine child support. These calculations vary by state, but every state uses one of three models: the income shares model, the percentage of income model, or the Melson formula model. Let’s dive into the world of alimony, unravel its nuances, and understand how a Texas alimony calculator can be a valuable tool in this journey.

Article Outline

1. Understanding Spousal Maintenance

- Definition and Purpose

- Eligibility Criteria

- Factors Courts Consider When Deciding Spousal Maintenance Awards

2. Calculating Alimony: The Alimony Calculator Demystified

- Texas Alimony Calculator: A Closer Look

- How Courts Use Calculators in Determining Alimony

- Limitations and Considerations in Alimony Calculations

3. Spousal Maintenance Orders: What You Need to Know

- Types of Maintenance Orders

- Modifying Alimony: When and How

- Enforcing Alimony Orders

4. Alimony and Taxes in Texas

- Tax Implications for Payers and Recipients

- How Changes in Tax Laws Affect Alimony

- Strategies for Managing Taxes in Alimony Cases

5. Family Law and Alimony: Navigating the Legal Landscape

- Texas Family Code and Alimony

- Role of Family Law Attorneys in Alimony Cases

- Common Challenges and Solutions in Alimony Proceedings

6. Factors Courts Consider When Deciding Spousal Maintenance

- Marital Misconduct and Its Impact

- Earning Power and Employment History

- Physical or Mental Disability: How It Influences Alimony

7. How to Get Spousal Maintenance: Eligibility and Process

- Establishing Need for Support

- Requesting Spousal Maintenance in Texas

- What to Expect During the Legal Process

8. Limitations on Spousal Maintenance: What You Need to Know

- Time Restrictions: Within Two Years of Divorce

- Conditions for Termination or Modification

- Alimony for Young Children of the Marriage

9. Alimony Agreements: Crafting a Fair Deal

- Negotiating Alimony Terms

- Enforceability of Alimony Agreements

- Seeking Legal Assistance in Crafting Agreements

10. Spousal Maintenance: A Holistic Perspective

- Balancing Financial Stability

- The Human Element: Emotional and Psychological Considerations

- Moving Forward After Alimony: Building a New Financial Future

Understanding Spousal Maintenance

Definition and Purpose: Alimony, or spousal maintenance, is a legal obligation for one spouse to provide financial support to the other after divorce or separation. Its primary purpose is to ensure that the lower-earning spouse can maintain a reasonable standard of living post-divorce.

Eligibility Criteria: Eligibility for spousal maintenance varies and is influenced by factors such as the length of the marriage, the recipient spouse’s ability to support themselves, and whether there was any marital misconduct.

Factors Courts Consider When Deciding Spousal Maintenance Awards: Courts take various factors into account when determining the amount and duration of spousal maintenance. Marital misconduct, earning power, and any physical or mental disability are crucial elements in this decision-making process.

Calculating Alimony: The Alimony Calculator Demystified

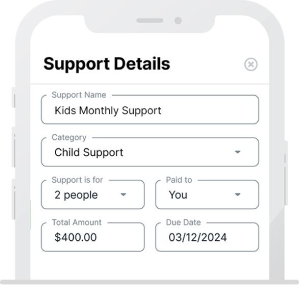

Texas Alimony Calculator: A Closer Look: Understanding how alimony is calculated can be complex, but tools like the Texas alimony calculator can simplify the process. It considers various financial factors to provide an estimate of the potential alimony amount.

How Courts Use Calculators in Determining Alimony: Courts use calculators as a starting point for alimony determinations, considering them alongside other relevant factors. While calculators provide estimates, the final decision is based on a holistic evaluation of the spouses’ financial situations.

Limitations and Considerations in Alimony Calculations: Despite their usefulness, alimony calculators have limitations. They may not account for exceptional circumstances, such as a sudden increase in earning power or a significant change in financial circumstances. It’s crucial to view calculator results as a guideline rather than an absolute measure.

Spousal Maintenance Orders: What You Need to Know

Types of Maintenance Orders: Maintenance orders can take various forms, including lump-sum payments, periodic payments, or a combination of both. Understanding the implications of each type is vital for both the paying and receiving spouse.

Modifying Alimony: When and How: Circumstances change, and so can alimony agreements. Courts may allow modifications if there’s a substantial change in either spouse’s financial situation. Whether due to increased earning power or incapacitating physical or mental disability, seeking a modification requires legal guidance.

Enforcing Alimony Orders: Once an alimony order is in place, it’s essential to understand how to enforce it. Courts have mechanisms in place to ensure compliance, and failure to pay alimony as ordered can have legal consequences.

Court Ordered Spousal Maintenance and Taxes in Texas

When it comes to court-ordered spousal maintenance and taxes in Texas, both the paying and receiving spouses should be aware of the financial implications. For the paying spouse, it’s important to note that alimony or spousal maintenance payments are tax-deductible, providing potential relief during tax season. On the flip side, recipients of spousal maintenance must recognize these payments as taxable income. Navigating these tax intricacies requires a thoughtful approach during divorce negotiations and a clear understanding of how the court order will impact both parties’ financial positions. Seeking professional advice from tax experts and legal professionals can be instrumental in ensuring compliance with tax laws and optimizing the financial outcome for both spouses involved. Additionally, staying informed about any changes in tax regulations pertaining to spousal maintenance is crucial for making informed decisions during and after the divorce process.

Alimony and Taxes in Texas

Tax Implications for Payers and Recipients: Alimony has tax implications for both the paying and receiving parties. Understanding the tax consequences can impact decision-making during negotiations.

How Changes in Tax Laws Affect Alimony: Tax laws regarding alimony have undergone changes in recent years. Knowing the current tax landscape is crucial for making informed decisions.

Strategies for Managing Taxes in Alimony Cases: Both parties can employ strategies to minimize tax burdens associated with alimony. Proper planning can lead to more favorable outcomes for both the payer and recipient.

Family Law and Alimony: Navigating the Legal Landscape

Texas Family Code and Alimony: The Texas Family Code outlines the legal framework for spousal maintenance. Familiarity with these laws is essential for anyone navigating the complexities of alimony in Texas.

Role of Family Law Attorneys in Alimony Cases: Experienced family law attorneys play a crucial role in alimony cases. They provide guidance on legal strategies, negotiate on behalf of their clients, and ensure all relevant factors are considered.

Common Challenges and Solutions in Alimony Proceedings: Alimony cases often present challenges, from disputes over eligibility to disagreements on the amount and duration. Understanding common challenges and potential solutions is key to a smoother legal process.

Factors Courts Consider When Deciding Spousal Maintenance

Marital Misconduct and Its Impact: Marital misconduct, such as infidelity or financial mismanagement, can influence spousal maintenance decisions. Courts weigh the impact of such behavior on the requesting spouse’s financial situation.

Earning Power and Employment History: The earning power of each spouse and their employment history are significant factors. Courts assess the paying spouse’s ability to meet their own needs while contributing to the financial support of the other.

Physical or Mental Disability: How It Influences Alimony: A spouse with a physical or mental disability may have unique financial needs. Courts consider the impact of the disability on the individual’s ability to earn income and may award additional support.

How to Get Spousal Maintenance: Eligibility and Process

Establishing Need for Support: To qualify for spousal maintenance, the requesting spouse must demonstrate a genuine need for financial support. This involves presenting evidence of financial dependency and an inability to meet reasonable needs independently.

Requesting Spousal Maintenance in Texas: The process of requesting spousal maintenance involves legal filings and presenting a case before the court. Understanding the procedural steps and requirements is crucial for a successful application.

What to Expect During the Legal Process: Navigating the legal process for spousal maintenance involves court hearings, negotiations, and potentially mediation. Knowing what to expect can alleviate stress and facilitate better preparation.

Limitations on Spousal Maintenance: What You Need to Know

Time Restrictions: Within Two Years of Divorce: In Texas, there are time restrictions on seeking spousal maintenance. A spouse must request support within two years of the divorce to be eligible.

Conditions for Termination or Modification: Spousal maintenance may be terminated or modified under certain conditions, such as the recipient spouse’s remarriage or a significant change in financial circumstances.

Alimony for Young Children of the Marriage: When there are young children involved, courts may consider additional factors in awarding spousal maintenance to ensure the well-being of the custodial parent.

Alimony Agreements: Crafting a Fair Deal

Negotiating Alimony Terms: Negotiating alimony terms requires a careful consideration of each spouse’s financial situation and needs. A fair and equitable agreement is essential for both parties’ financial stability.

Enforceability of Alimony Agreements: Once an agreement is reached, ensuring its enforceability is crucial. Legal assistance can help draft agreements that stand up to legal scrutiny and protect the interests of both parties.

Seeking Legal Assistance in Crafting Agreements: Family law attorneys play a crucial role in crafting enforceable alimony agreements. Their expertise ensures that the terms are fair, reasonable, and legally sound.

Spousal Maintenance: A Holistic Perspective

Balancing Financial Stability: While financial considerations are paramount, it’s crucial to approach spousal maintenance decisions holistically. Balancing financial stability with emotional and psychological well-being is essential for a successful post-divorce life.

The Human Element: Emotional and Psychological Considerations: Divorce is emotionally taxing, and spousal maintenance adds another layer of complexity. Understanding the emotional and psychological aspects of alimony is vital for both parties’ well-being.

Moving Forward After Alimony: Building a New Financial Future: Spousal maintenance is a temporary solution. Both parties should focus on building a new financial future post-divorce, whether through education, career development, or other means.

Conclusion: Key Takeaways

- Alimony, also known as spousal maintenance, is a critical aspect of divorce proceedings.

- Understanding the factors that influence alimony calculations is essential for informed decision-making.

- Texas alimony calculator can provide estimates but should be used alongside legal guidance.

- Family law attorneys play a crucial role in navigating the legal complexities of alimony cases.

- Balancing financial stability with emotional well-being is key to a successful post-divorce life.

Navigating the intricacies of alimony in Texas requires a deep understanding of family law, financial considerations, and the emotional toll of divorce. Armed with knowledge and legal guidance, individuals can approach alimony proceedings with confidence, ensuring fair and equitable outcomes for all parties involved. SupportPay is here for you, making financial management easier during challenging times. Visit https://www.supportpay.com for support. Your peace of mind is our priority.