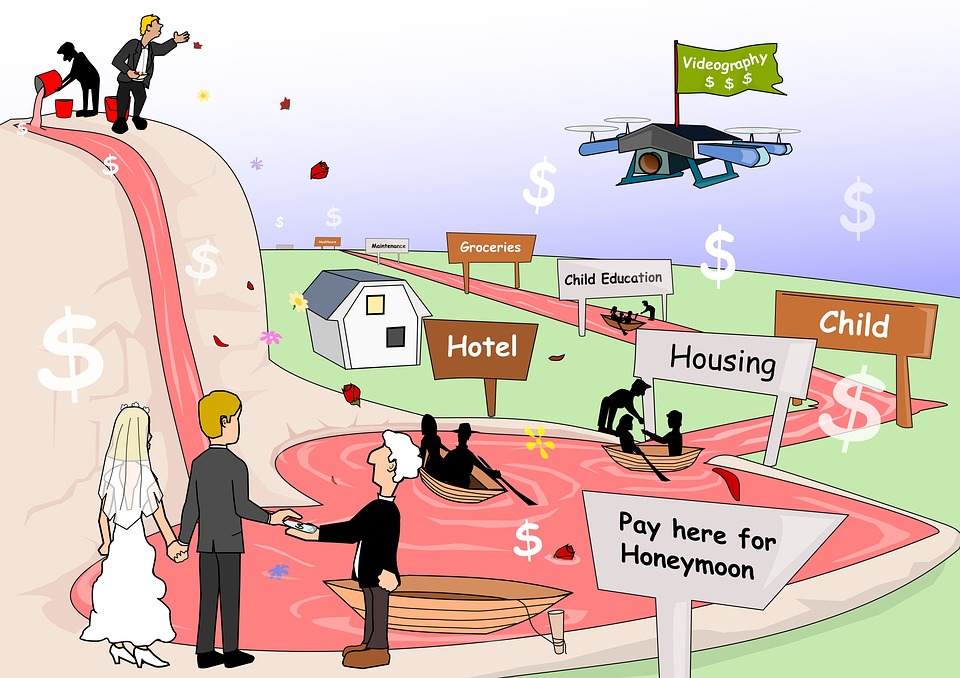

How to Get a Handle on Finances Early in Life

The earlier in life you figure out how to manage your money, the better off you’ll be financially in the long run. Not only is getting a handle on your finances good for your bank account, but it’s also good for your health, too. According to the American Psychological Association, more than 70 percent of Americans feel stressed about money on at least a monthly basis. Considering that stress can lead to digestion issues, sleep problems, chest pain, and worse, mastering money management while you’re young will improve your quality of life as the years go by.

Learn How to Use Debt Wisely

Most young adults aren’t taught how to best handle credit and debt. While, generally speaking, it’s smart to avoid debt whenever possible, it’s not that simple. In fact, being scared to ever use credit is almost as bad as going deep into debt.

You’ll likely need to take on some debt to further your education and buy a home. In both cases, this type of debt is extremely helpful, as a college degree increases your earning potential and individuals who own a home are much wealthier on average than individuals who don’t.

Additionally, many credit cards offer incentives such as cash-back or airline miles. As long as you pay off the credit cards every month, there are no risks to temporarily going into debt by using a credit card to pay for everyday expenses.

Live Below Your Means

Instead of living paycheck to paycheck, make it a point to live below your means. The first step in doing so is to create a budget. List all your income and all of your monthly expenses. While doing this, you may be able to find areas where you can cut back. For example, you may be surprised by how much you spend eating at restaurants or shopping online.

Once you’ve created a budget, track your spending on a daily basis. Apps such as YNAB or Mint can help make that much easier than it sounds. These apps can connect with your credit card and bank accounts to automatically track and categorize your spending.

Learn How to Smartly Shop

Shopping is an overlooked artform. It’s easy to waste thousands of dollars a year by being a poor shopper. In addition to using a cash-back credit card, you can search the internet for coupons, promo codes, and other special offers. If you’re shopping Best Buy, for example, you should keep an eye out for weekly ads and daily deals that can save you money. According to this Best Buy shopping guide, the retailer also has deals specifically for students, offers a price match guarantee, and a My Best Buy membership program that can score you perks such as free shipping, early access to sales, and exclusive deals.

Also, experienced shoppers will know that certain times of the year — particularly around Black Friday and Cyber Monday — are a great time to find deals. Whenever possible, plan your purchases far in advance. This allows you to save up money to buy what you want and have the needed funds once the items you are tracking goes on sale.

Start Saving for Retirement Today

Fidelity suggests that you should save at least 15 percent of your income with retirement in mind. Even if you’re young and retirement sounds like it’s in the distant, distant future, you can never start saving too early. To see the power of compounding interest, consider this: If you save just $1,000 a month, you could become a millionaire in as soon as 22 years. In 40 years, you could have more than $6 million — it’s something to keep in mind.

When you’re young, money matters usually aren’t on the top of the list. However, by taking a few simple steps such as mastering the use of credit and debt, living below your means, and figuring out the art of shopping, you can build wealth while avoiding common pitfalls.

Photo via Pixabay

This article was contributed by:

Janice Russell – Blogger/Writer

Janice Russell believes the only way to survive parenthood is to find the humor in it. She created Parenting Disasters so that parents would have a go-to resource whenever they needed a laugh, but also to show parents they aren’t alone.

Website: parentingdiasters.com