When you have a baby, some things, like choosing a nursery color, can wait. Others can’t. Financial concerns fall into the latter category.

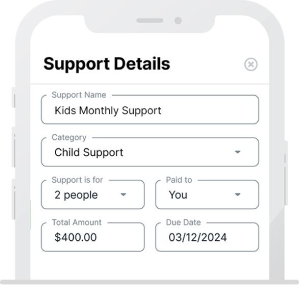

SupportPay is dedicated to helping moms and dads co-parent effectively by supporting their financial efforts. Their app helps manage expenses, child support payments and much more, so make sure it’s part of your budgeting plan.

As you create sound financial footing for your family, explore these pressing issues to take care of now so that you aren’t struggling to catch up later.

Home Sweet Home

Buying a house is not an absolute must when you start a family. But, if it is in your plans, sooner is almost always better than later. You have to come up with a down payment, which can be an obstacle. Fortunately, Better Money Habits notes some loans require as little as 3% cash at closing. Others require 20% of the sale price, and you will need to qualify for the best rates with your lender of choice. Keep in mind that if you don’t have 20%, you will also be on the hook for mortgage insurance.

Safety Nets

While your insurance provider will certainly get a bill from the hospital for labor and delivery, they probably won’t automatically add your newest family member to your policy. The Nest points out you have some hoops to jump through, and you usually only have between 30 and 60 days to get it done – as if your present financial concerns weren’t enough. If you don’t contact them during this grace period, you may wind up paying out-of-pocket for any doctor visits or medical services they have received.

Life insurance is something else to consider. Although no one wants to think about it, if you die today, your surviving spouse is going to have to pay for your funeral, potentially at the expense of your children’s financial stability – and if you work outside the home, there will be a loss of income.

Protect Yourself and Your Business

Being a business owner and a first-time parent may seem overwhelming, but with some good advice, you can ensure that both come together smoothly. For instance, take steps to register your business with the state, which will help separate your business finances from your personal finances. Additionally, consider making quarterly payments to Uncle Sam in order to stay on top of your taxes — the last thing you want is to get behind, which can result in penalties and interest charges. Managing your finances daily can also help you tackle any problems before they become serious. Starting a family and running a business can often seem intimidating, but having a good plan in place (and following it!) can make all the difference.

Save for Your Future

Don’t forget to stick money back for your own retirement. While paying for college is certainly important, you can’t rely on Social Security to keep you afloat when you retire. Many experts believe that Social Security benefits may be reduced within the next 15 years. Because of this, and for your own peace of mind, it makes sense to make alternate savings arrangements now. One easy way to start sticking money back is to invest in your company-sponsored 401(k). You can have money diverted directly from your paycheck, meaning you don’t have to remember to save because it’s automatic. Similarly, you can start an investment of your own if you’re self-employed.

Cover Snafus

Don’t panic, but you need an emergency fund. Death is not the only situation where your family might lose your income; this can happen because of layoffs or injuries that make it impossible for you to work. Some financial experts suggest having at least three months’ worth of living expenses socked aside for a rainy day.

Daily Low-Down

Finally, you can’t skip thinking about how much you’ll need for now. Diapers, wipes, baby food, toys, clothes…these things add up to around $12,000 the first year as a parent, per Parenting magazine. Take a look at your income and budget accordingly. It’s especially hard to stay on track if you’re co-parenting, but an all-inclusive app like SupportPay will help.

Money becomes an overwhelming issue when you throw children into the mix. After all, you have to look out for their future as well as your own without sacrificing today. It’s not always easy, but take heart knowing that it isn’t as scary as it sounds. And you don’t have to be a millionaire to afford to start a family. With a little forethought and a few smart budget moves, you can settle into your new role with your financial concerns in check.

Author of this article is Janice Russell

• Company: Parenting Disasters

• Position: Blogger

• Email: janice@parentingdisasters.com

• Website: parentingdisasters.com

Janice Russell believes the only way to survive parenthood is to find the humor in it. She created Parenting Disasters so that parents would have a go-to resource whenever they needed a laugh, but also to show parents they aren’t alone.