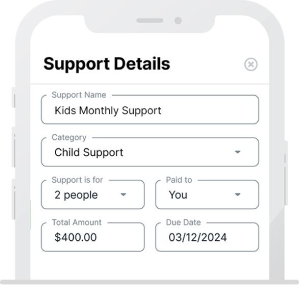

No matter what state you live in, there are some general guidelines when it comes to calculating child support. Always go directly to your state’s specific link and use their calculators to get started. Before you go however, be sure to gather these things to make the process simpler. We have gathered up some tips on how to get and pay child support.

- Income tax information for federal and state

- Monthly wages/salary, need a pay stub

- Record of disability/unemployment

- New spouse wages

- Public assistance records

- Any current paid child support to previous family

- Property tax

- Mortgage Interest

- Union dues

- Health Insurance

- Mandatory retirement contributions

- Job related expenses

These will help you confirm all of your income and expenses so that a correct calculation can be made. Remember, the calculators are just a close estimate. They also help you to gather the necessary documentation that you would need to provide a lawyer. Be sure to consult with your lawyer or a judge to confirm what is required, and to be certain an official court order is in place. There are things that may affect a spouse’s ability to pay that you should be aware of. Here are some reasons why parents don’t pay child support

Jail

- If the parent is incarcerated, the ability to pay child support does not apply.

Military

- If the parents haven’t agreed on payment terms and there is not a court order yet, you can consult with the military regarding the paying parent in the meantime. Each branch of the military has guidelines set up for interim family support before the court order for support is in place. Generally this will be less than what the courts decide, but at least it will be something while you wait. Be sure to check with the legal services office for the specific branch of the military.

- Calculating income for a service member may prove a bit more difficult simply because their paychecks are not like any other. There is a housing allowance involved and other possible additions. So, when trying to find a gross income for the paying parent in the military, be sure to use the LES (Leave and Earning Statement) rather than a tax return. Some of their income may be tax-free, so you want to be sure you are getting an accurate reading on what they bring in.

Complex Families

- If there are former spousal support orders or child support orders from a previous relationship, these take preference over any current child support situation. This could affect how much is left over to help provide for your child.

- A new spouse’s income (after a remarriage) may affect the amount of child support given/required in some states.

Considerations

- Courts look at parents’ standard of living, ability to pay support, their age/stage in life, the child’s needs and well being, health status, and many other discretionary factors to establish support. Remember that the goal here is to support your child and give them a healthy, happy life. Whatever it takes to do that should be worth it.