The Division of Child Support Enforcement (DCSE)

“is proud of the work we do to help children in Virginia. Last year, DCSE located 153,868 noncustodial parents, established 7,768 paternities and collected more than $639 million (an increase of 1.5 percent over the previous year) for the children of Virginia. Still, unpaid child support is a significant problem. Currently, there are 353,000 child support cases in Virginia. Collectively, 422,000 of Virginia’s children are owed more than $2.6 billion.” — DCSE

Overview

To calculate child support in Virginia the DCSE uses the Income Shares Model. The Income Shares Model estimates the amount of money that would have been available to the child if the parents had not divorced or separated. This estimated amount is then divided proportionately between the parents based on their income.

The first step in calculating child support in Virginia is to determine each parent’s gross income. Gross income includes all forms of income, such as: wages, salaries, tips, bonuses, commissions, self-employment income, interest and dividends, alimony and spousal support from a previous relationship, pension and retirement income, Social Security benefits, unemployment compensation, workers’ compensation benefits, and any other source of regular financial support.

Once each parent’s gross income has been determined, the court will then consider any relevant deductions, such as: taxes, mandatory union dues, mandatory retirement contributions, and health insurance premiums.

After the deductions have been made, the court will then calculate each parent’s net income. The net income is the amount of money that each parent has available to spend on themselves and their child after all necessary deductions have been made.

Once the net incomes of both parents have been determined, the court will then apply a percentage to the non-custodial parent’s income.

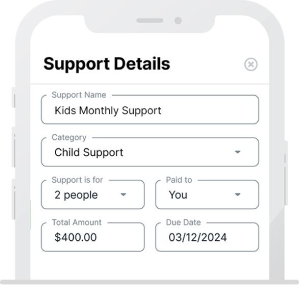

After the percentage has been applied to the non-custodial parent’s income, that amount is then considered to be the child support obligation. The child support obligation is the amount of money that the non-custodial parent is required to pay each month to support their child.

In Virginia, the court can order the non-custodial parent to pay child support directly to the custodial parent or to the Virginia Department of Social Services. If the non-custodial parent fails to make their required child support payments, the court can take a number of enforcement actions, such as: wage garnishment, tax refund interception, license suspension, and contempt of court.

If you have any questions about child support in Virginia, or if you need help calculating your child support obligation, you can use our Child Support Calculator below or contact your local Virginia child support services office.

Virginia Child Support Resources

Virginia DSS

Division of Child Support Enforcement, Department of Social Services

801 East Main Street, 12th Floor

Richmond, Virginia 23219

Office: (800) 257-9986

Fax: (804) 726-7476