Sheri Atwood

November 5, 2022

Texas Child Support: Essentials and Guidelines for Parents

Are you navigating the Texas child support system? This guide helps parents understand how child support works in Texas. From applying for child support and calculating payments to enforcement and modifications, we cover the essentials you need to know.

Key Takeaways

- Texas child support ensures custodial parents receive financial support from non-custodial parents, with procedures in place for calculating payments based on net income.

- Paycheck withholding is a legal mechanism used in Texas to ensure consistent child support payments, with employers required to comply with withholding orders.

- Child support obligations generally end when the last child turns 18 or graduates from high school, but exceptions exist for children with disabilities and in cases of non-compliance.

Understanding Child Support in Texas

The mission of Texas child support services is straightforward: to ensure that children receive the financial support they need. This system is designed to help custodial parents secure the necessary funds from non-custodial parents to cover the costs of raising a child. Parents in Texas can start a child support case by applying online or in person after requesting the necessary forms. This process ensures both parents contribute to their child’s well-being, despite personal differences.

When parents are unable to reach an agreement on child support issues, the situation often escalates. The case is generally moved to government courts for resolution. Clearly classifying covered expenses in writing helps avoid conflicts. Such clarity aids negotiations and ensures both parties understand their financial responsibilities.

Additionally, as children grow older, parents should anticipate increased expenses for school and extracurricular activities. Consulting an experienced attorney can offer valuable insights and support for detailed guidance.

How Child Support Payments Are Calculated

Calculating child support payments in Texas is based on the net income from all sources of the paying parent. The Texas child support guidelines specify that for one child, the base percentage of the paying parent’s net income is 20%, with this percentage increasing with the number of children to a maximum of 40% for five or more children. This structured approach ensures that the financial support is proportional to the parent’s ability to pay and the number of children requiring support.

The Texas child support formula applies only to the first $9,200 of net resources for parents with income exceeding this threshold, unless specific needs justify higher payments. This cap ensures that child support obligations are reasonable and manageable, considering the parent’s financial situation. Additional considerations include the baseline needs of the child and any disability benefits the parent or child might receive, which can influence the support amount.

Child support calculations are not static. They can be adjusted based on changes in circumstances, such as significant increases or decreases in the paying parent’s income or changes in custody arrangements. Such flexibility ensures the support meets the child’s evolving needs over time and helps to calculate child support effectively.

What Can Be Withheld from Paychecks?

One effective method to fulfill child support obligations is paycheck withholding. A child support order will specify the monthly payment responsibilities, including medical and dental support. In Texas, these amounts can be directly deducted from the non-custodial parent’s wages. Employers are legally required to honor these income withholding orders, whether issued by a Texas court or another state, as long as they appear valid.

Employers must continue to withhold child support until they receive an official order terminating the withholding. These withholding orders take precedence over other types of garnishments, such as those for non-tax debts. To cover the administrative costs of processing these withholdings, employers may deduct a small fee from the employee’s disposable earnings.

This system guarantees consistent and timely child support payments, alleviating the custodial parent’s financial burden.

Duration of Child Support Obligations

In Texas, child support obligations generally conclude when the last child reaches 18 years of age. Alternatively, they may end when the child graduates from high school, depending on which event occurs later. However, there are exceptions to this rule. For instance, child support may continue indefinitely for a child with a disability, depending on the child’s ongoing needs. This provision guarantees children with special needs receive financial support throughout their lives.

Even if parental rights have been terminated, the obligation to pay child support continues until the child is adopted or specific legal circumstances change. Additionally, if a parent fails to meet their child support obligations, enforcement actions can be taken through the courts. Payments must continue until any owed back support, including interest, is paid in full. This measure ensures custodial parents and their children have the necessary resources.

Modifying Child Support Orders

Life is full of changes, and sometimes these changes necessitate a modification of child support orders. If there is a substantial change in circumstances, such as a job loss or a significant change in custody arrangements, child support can be adjusted. To initiate a modification request, parents must have an existing active child support case.

The process involves submitting a formal request for review to the Child Support Division. Only one modification request should be made at a time to avoid processing delays.

The state where the original child support order was made retains the authority to modify it, provided one of the parties still resides in that state. This system handles modifications efficiently and fairly.

Role of the Texas Attorney General in Child Support Cases

The Texas Attorney General’s office plays a pivotal role in child support cases, especially when parents do not fulfill their payment obligations. The Child Support Division is responsible for collecting and distributing child support payments, ensuring that children receive the financial support they need.

Parents struggling with payments should seek assistance promptly to avoid enforcement actions. Enforcement mechanisms employed by the Attorney General’s office include license suspension and denial of motor vehicle registration renewal for non-compliance with child support orders. These measures ensure parents meet their obligations and children receive deserved support.

Enforcing Child Support Across State Lines

Child support enforcement does not stop at state borders. The Uniform Interstate Family Support Act (UIFSA) allows Texas to enforce child support orders from other states and vice versa. This ensures parents cannot evade responsibilities by moving to another state.

Texas child support orders can be registered and enforced in other states, providing legal backing across jurisdictions. This can also extend internationally, depending on the country. The UIFSA framework ensures that children receive consistent support, regardless of where their parents reside.

Addressing Disputes Over Child Support

Disputes over child support can be stressful and challenging. Good faith negotiation and reasonableness are key to a fair agreement. If parents cannot agree on child support, it is advisable to consult with a lawyer.

In cases where disputes cannot be resolved amicably, the Office of the Attorney General can request a judge to make an order for child support. Attorneys can assist parents struggling with child support payments by determining amounts, filing suits, and hiring investigators in child support court.

Establishing paternity is crucial in child support cases to create legal fatherhood and foster emotional bonds. Seeking help from a Texas divorce and family law attorney can provide valuable assistance in resolving these issues.

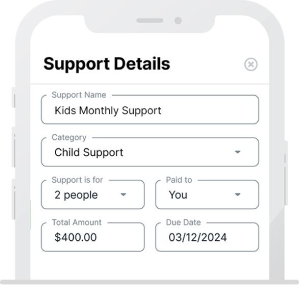

Payment Options and Methods

There are several payment options and methods for child support in Texas. All payments must go through the Texas Child Support Disbursement Unit to ensure proper recording. This centralized system helps avoid delays and ensures that payments are correctly accounted for.

Including case numbers with child support payments helps avoid processing delays. The choice of payment method, such as a money order, can depend on various factors, including the size of the company and banking capabilities. This flexibility allows parents to choose the most convenient and efficient way to make their payments.

Impact of Disability Benefits on Child Support

Disability benefits can significantly impact child support calculations and obligations. The court offsets the amount of benefits paid to or for the child in child support calculations. This means that disability benefits can either increase or decrease the amount of child support owed, depending on the circumstances.

Child support withholding can also apply to disability benefits. This means that a portion of those benefits may be deducted for child support payments. This ensures that children continue to receive financial support regardless of the parent’s disability status. Understanding how disability benefits impact child support is crucial for navigating the system.

Resources for Texas Families

Navigating the child support system can be challenging; however, several resources are available to assist Texas families. The Texas Bar Association offers a referral directory to find legal aid organizations statewide. TexasLawHelp.org maintains a directory of legal services providers categorized by service area.

The Texas Legal Services Center provides free legal assistance, especially to rural residents based on income. Lone Star Legal Aid serves low-income clients across 72 counties in east Texas and parts of Arkansas. Families in need of legal support should seek assistance from these organizations to ensure they are informed and equipped to navigate the child support system.

Summary

Understanding and navigating the child support system in Texas is crucial for ensuring that children receive the financial support they need. From calculating payments to modifying orders and addressing disputes, each aspect of the system plays a vital role in securing children’s well-being.

The Texas Attorney General’s office and various legal resources provide essential support to parents navigating these challenges. By staying informed and seeking assistance when needed, parents can ensure that they fulfill their obligations and support their children’s growth and development.

Frequently Asked Questions

How is child support calculated in Texas?

Child support in Texas is calculated using the paying parent’s net income, applying specific percentage guidelines based on the number of children involved. This ensures a fair contribution toward the child’s financial needs.

Can child support orders be modified?

Child support orders can indeed be modified when there is a substantial change in circumstances, such as job loss or changes in custody arrangements. It is essential to demonstrate these changes to pursue a modification effectively.

What happens if a parent fails to pay child support?

If a parent fails to pay child support, enforcement actions may be taken by the Texas Attorney General’s office, which can include license suspension and denial of motor vehicle registration renewal. It is crucial for parents to fulfill their financial obligations to avoid these consequences.

Are disability benefits included in child support calculations?

Disability benefits can indeed be included in child support calculations and are subject to child support withholding. Therefore, they may impact the final amount determined for child support obligations.

Where can Texas families find legal assistance for child support issues?

Texas families can seek legal assistance for child support issues through the Texas Bar Association, TexasLawHelp.org, and Lone Star Legal Aid. These resources will provide the necessary support for navigating child support matters.

Texas Child Support Resources

- Child Support Information

- Make A Payment

- Child Support Forms

- Child Support Guidelines

- Child Support Calculator

- Child Support Healthcare Reimbursement

Texas Child Support Services Contact Information

Child Support Division, Office of the Attorney General

PO Box 12017

Austin, Texas 78711-2017

Office: (800) 252-8014

Fax: (512) 460-6867

Alabama-Coushatta Tribe of Texas

Tribal Administrator

571 State Park Road

Livingston, Texas 77351

Office: (936) 563-1100

Email: stephanie.williams@ actribe.org