Top Alabama Child Support Tips for Parents

Are you navigating Alabama child support laws and need clear guidance? This article covers essential information on calculating payments, understanding guidelines, modifying orders, and enforcement. Get the facts you need to ensure your child’s financial future in Alabama.

Key Takeaways

Alabama’s child support guidelines, established under Rule 32, provide a standardized approach for calculating support based on the combined income of both parents and the child’s financial needs.

Factors such as employment status, number of children, extraordinary expenses, and potential earning capacity all contribute to the final child support amount determined by the courts.

Modifications to child support orders are possible with evidence of material changes in circumstances, and courts have discretion to deviate from standard guidelines under certain conditions.

Understanding Alabama Child Support Guidelines

Rule 32 of the Alabama Rules of Judicial Administration governs child support in Alabama. This rule provides a framework for calculating child support payments, ensuring a standardized approach across the state based on the combined incomes of both parents.

The guidelines primarily consider the gross income of both parents. Alabama courts use this combined income to establish child support obligations through a standardized formula, ensuring that financial responsibilities are shared equitably according to each parent’s ability to contribute.

Courts also consider the financial needs of the child and the parents’ ability to meet those needs. While the formula provides a starting point, the final child support order may be adjusted based on additional factors. Alabama family courts can consider elements beyond the standard guidelines, impacting the final determination.

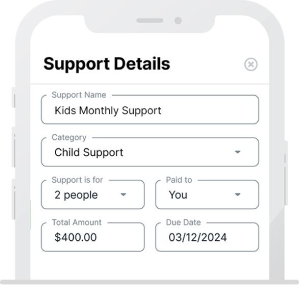

Calculating Child Support Payments

The calculation of child support payments in Alabama starts with determining the gross income of both parents. This step sets the foundation for subsequent calculations. Once calculated, the gross incomes are summed to find the combined gross income.

The combined gross income is applied to a schedule of basic child support obligations, a standardized chart that helps determine the initial support amount. This chart simplifies the process by providing a clear reference based on income levels, ensuring consistent calculations.

The final child support obligation is divided between the parents according to their adjusted gross incomes, reflecting the proportionate responsibility each parent has based on their earnings. For instance, if both parents earn $2000 monthly and have $50 in child care costs, the total child support obligation could be $596.

This method ensures that each obligor parent substantially pays a fair share relative to their income towards the child’s upbringing, especially for one parent. While the process may seem complex, understanding each step can help you prepare for your financial responsibilities.

Factors Influencing Child Support Amounts

Several factors influence the final amount of child support in Alabama. Courts consider the gross income of both parents, their employment status, and potential earning capacity, ensuring the support amount reflects the realistic financial situation of each parent.

The number of children and their specific needs play a significant role in determining support amounts. Factors such as the child’s age and medical conditions directly influence the required financial support. Additional expenses like child care related to a parent’s work schedule or job hunting are also considered.

Extraordinary expenses, such as healthcare or extracurricular activities, can further impact the total child support obligation. Courts may consider transportation costs related to visitation and allow modifications based on shared physical custody arrangements and other personal circumstances.

Modifying a Child Support Order

Life is dynamic, and so are the circumstances that affect child support. A parent must demonstrate a material change in circumstances to modify a child support order. This change could be due to job loss, changes in custody, or increased financial needs of the children. Additionally, a parent may need to change child support based on these new circumstances.

The child must be under 19 and unmarried for a modification to apply. Either parent or legal custodian can request a change in the support amount by filling out specific forms and filing them with the court. The other parent will be served a copy of these forms when a new support order request is made.

A court order is essential to alter or terminate a child support agreement. Judges must provide written reasons for any deviations from the Alabama Child Support Guidelines to ensure decisions are transparent and justified.

Deviation from Standard Guidelines

In certain instances, courts may deviate from standard child support calculations. Alabama courts have broad discretion in adjusting child support obligations based on varying circumstances, such as shared custody or extraordinary expenses.

Additional parenting time, job loss, or significant pay raises can be valid reasons for courts to deviate from the standard child support guidelines. If a parent is believed to be deliberately reducing their earnings, courts can impose an estimated income to ensure fair child support payments.

Imputing Income for Underemployed Parents

In cases where a parent is underemployed or unemployed, Alabama courts may impute income. Instead of using the parent’s actual earnings, the court estimates their earning potential, preventing parents from avoiding their child support responsibilities by deliberately earning less.

Courts consider both parents’ earnings and potential income in child support calculations, ensuring the amount reflects what the parent could reasonably be expected to earn.

Special Considerations in Alabama Child Support Cases

Certain special considerations can affect child support calculations in Alabama. For instance, if parents agree on private school attendance for their child, these tuition costs should be factored into the calculations.

Child support obligations may extend beyond the age of 18 if the parents expect the child to attend college and the child remains financially dependent. Extravagant expenditures by the custodial parent that neglect the child’s basic needs can lead the non-custodial parent to seek legal intervention or modification of child support.

Enforcement of Child Support Orders

When a parent fails to fulfill their child support obligations, enforcement strategies are implemented to recoup owed amounts. Wage garnishment is a common method, where a portion of the parent’s income is directly deducted to cover child support payments. Additionally, a parent’s bank accounts may be subject to garnishment, and tax refunds can be intercepted by the state to satisfy unpaid child support obligations.

Failure to pay child support may result in the suspension of a parent’s professional or driver’s licenses. Legal actions for non-payment can lead to contempt of court charges, which may incur fines or even incarceration. These enforcement measures highlight the importance of meeting child support obligations to avoid severe consequences.

Summary

Understanding Alabama’s child support guidelines is essential for ensuring that children receive the financial support they need. By following the standardized calculations, considering various influencing factors, and knowing how to modify or enforce support orders, parents can navigate this complex system more effectively.

Staying informed and proactive about child support responsibilities helps maintain fairness and promotes the well-being of your children. Remember, knowledge is not just power; it is the key to ensuring your child’s future.

Frequently Asked Questions

How is child support calculated in Alabama?

Child support in Alabama is determined using a standardized formula that considers the gross incomes of both parents. This calculation helps establish the initial support amount necessary for the child’s welfare.

Can child support amounts be modified?

Child support amounts can indeed be modified when there is a material change in circumstances, such as job loss or increased financial needs of the children. It is essential to address these changes through the appropriate legal channels.

What happens if a parent fails to pay child support?

If a parent fails to pay child support, enforcement measures like wage garnishment, bank account garnishment, tax refund interception, and license suspension may be implemented to recover the owed amounts. It is essential to understand that non-payment can lead to serious financial and legal consequences.

Are there any special considerations for child support in Alabama?

In Alabama, special considerations for child support include factors such as private school tuition, extended support for college, and managing extravagant expenses incurred by the custodial parent. These aspects help ensure that child support arrangements reflect the child’s needs comprehensively.

What does it mean to impute income for child support?

Imputing income for child support means the court assesses a parent’s potential earnings rather than their actual income to ensure they fulfill their financial responsibilities towards their child. This approach prevents any circumvention of support obligations.

Alabama Child Support Resources

Alabama DHR

Department of Human Resources

50 Ripley Street

PO Box 304000

Montgomery, Alabama 36130-4000

Office: (334) 242-9300

Fax: (334) 242-0606