Written by: John Reilly

The aftermath of divorce brings significant changes, but rebuilding financial independence as a single parent can be one of the most challenging. Shifting from a shared financial system to managing expenses on your own, all while prioritizing your children’s needs, can feel like navigating uncharted waters.

Understanding Your New Financial Reality

Transitioning from a dual-income household to managing finances solo requires a complete reassessment of your financial landscape. Beyond the immediate challenges of legal fees and establishing separate households, parents must adapt to new financial routines while ensuring their children’s needs are met consistently.

When asked, “How to start over financially after divorce?” Matt Mayerle, Personal Finance Editor at CreditNinja, suggests, “Starting over financially begins with understanding your new financial reality. Create a detailed budget that includes all sources of income and essential expenses. Set up an emergency fund, even if you can only contribute a little at a time. Focus on building or rebuilding your credit by managing debts responsibly and paying bills on time. Consulting a financial advisor can also help you navigate complex decisions and plan for both short-term needs and long-term goals, ensuring a path to financial stability.”

Child support payments, while helpful, rarely cover all expenses associated with raising children. The key lies in developing a comprehensive understanding of your new financial picture, including all sources of income, fixed expenses, and variable costs that may arise. This awareness forms the foundation for building a sustainable financial future.

Creating Stability Through Smart Money Management

Financial stability after divorce isn’t just about maintaining current expenses—it’s about building a secure future for yourself and your children. Start by establishing a clear separation between your finances and your ex-spouse’s, even in matters beyond child support and alimony. This means opening new accounts, establishing your own credit history, and creating independent financial records.

Consider working with a financial advisor who specializes in post-divorce planning. They can help you navigate complex decisions about retirement accounts, investments, and long-term financial strategies. While the cost might seem daunting initially, professional guidance can prevent costly mistakes and help secure your financial future.

Navigating Common Financial Pitfalls

The path to financial independence often comes with unexpected challenges. While some newly single parents resort to quick fixes like bad credit loans online during emergencies, building a robust financial safety net offers more sustainable solutions. Focus on establishing an emergency fund, even if you can only save small amounts initially.

Insurance becomes particularly crucial after divorce. Review and update all policies, including health, life, and disability insurance, to ensure adequate coverage for you and your children. Consider whether additional coverage is necessary now that you’re solely responsible for your household’s financial security.

Co-Parenting and Financial Communication

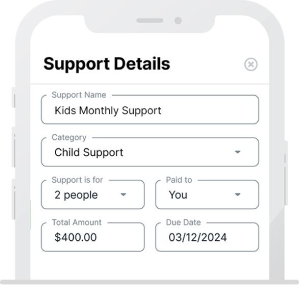

Maintaining clear financial boundaries while co-parenting requires excellent communication and documentation. Establish specific agreements about sharing expenses beyond basic child support, such as extracurricular activities, medical costs, or education expenses. Use co-parenting apps or dedicated spreadsheets to track shared expenses and payments, reducing potential conflicts.

Remember that financial decisions often impact parenting time and relationships. When planning major expenses or lifestyle changes, consider how they might affect your co-parenting arrangement and your children’s well-being.

Building Your Financial Independence Toolkit

Developing financial literacy becomes crucial in this new chapter of life. Familiarize yourself with budgeting tools, investment options, and tax implications of your new filing status. Consider taking financial management courses or working with a credit counselor to strengthen your financial foundation.

Matt Mayerle suggests, “Building a solid financial toolkit starts with understanding how credit works. Establishing or improving your credit score post-divorce will provide crucial financial flexibility, whether for housing, loans, or future investments.”

Start building your credit history if you previously shared accounts with your ex-spouse. This process takes time, but establishing a strong credit profile in your name provides crucial financial flexibility for future needs, from housing to employment opportunities.

Planning for Long-Term Success

Looking beyond immediate challenges, focus on building long-term financial security. This includes retirement planning, college savings for children, and creating an estate plan that protects your children’s interests. While these goals might seem overwhelming initially, breaking them down into manageable steps makes them more achievable.

Consider career development opportunities that could increase your earning potential. This might involve additional education, professional certifications, or exploring new career paths that better accommodate your parenting responsibilities while providing financial growth opportunities.

Self-Care in Financial Planning

Financial stress can take a significant toll on physical and emotional well-being. Remember that taking care of yourself financially is a crucial form of self-care that benefits you and your children. Set aside a small portion of your budget for personal development and stress management activities that help you maintain resilience during challenging times.

Creating a Legacy of Financial Wisdom

Use this transition as an opportunity to teach your children valuable financial lessons. Involve them in age-appropriate discussions about budgeting, saving, and making thoughtful spending decisions. These conversations can help them develop healthy financial habits while understanding the family’s new economic reality.

Embracing Your Financial Evolution

The journey from financial dependence to independence after divorce often unexpectedly mirrors personal growth. Many single parents discover financial capabilities they never knew they possessed, developing skills beyond managing a household budget. While challenging, this transformation often leads to a deeper understanding of financial management and personal strength.

Consider joining support groups or online communities for single parents navigating similar financial transitions. These networks can provide valuable insights, emotional support, and practical tips from others who have successfully managed similar challenges. Some parents even find that sharing their experiences helps others while reinforcing their financial confidence.

Creating new income streams through side businesses, freelance work, or strategic investments becomes more approachable as your financial confidence grows. The skills you develop during this transition—from negotiating payment plans to managing complex budgets—often translate into valuable professional assets.

Mayerle adds, “This financial transformation isn’t just about meeting immediate needs; it’s an opportunity to develop skills that lead to long-term stability. From managing complex budgets to finding new income streams, this process can empower single parents to thrive financially.”

Remember that your financial journey after divorce isn’t just about survival; it’s about creating a new foundation for thriving. Each successfully negotiated bill, each savings goal achieved, and each wise financial decision builds your financial security and your children’s understanding of resilience and self-reliance. This evolution from financial uncertainty to confidence may become one of the most empowering aspects of your post-divorce journey.

Moving Forward with Confidence

Remember that financial independence after divorce is a journey, not a destination. Celebrate small victories along the way, whether it’s building your first emergency fund or successfully navigating a financial challenge independently. Each step forward strengthens your financial foundation and sets a positive example for your children.

The path to financial stability may seem daunting, but with careful planning, consistent effort, and the right support systems, you can build a secure financial future for yourself and your children. Focus on progress rather than perfection, and remember that every financial decision is an opportunity to demonstrate resilience and responsibility to your children.

This new chapter in your life allows you to establish strong financial habits that will serve you and your family well into the future. By approaching your finances with intention and commitment, you’re not just securing your own independence—you’re creating a legacy of financial wisdom for your children to carry forward.

About The Author

John Reilly is a freelance content writer during the day and a bookworm at night with an extensive background in finance and investments. He also has a business degree and aims to educate people about financial literacy through his articles.