If you haven’t started doing your taxes yet, you’re running out of time to gather the necessary paperwork to meet this year’s April 15 filing deadline. And while many people believe filing taxes just means telling the IRS how much you made last year, there’s actually quite a bit more to it than that, especially if you’re paying or receiving alimony.

Reporting and Deducting Alimony On Your Income Taxes

Paying or receiving alimony (also known as spousal support depending on the state) can have a huge impact on your tax bill. The first general rule to remember is that if you’re receiving alimony, it counts as income that you have to report to the IRS. For tax purposes, alimony is treated as taxable income like anything you earn from your job. Income from alimony is reported on Line 11 of IRS Form 1040.

If you receive alimony, you also have to provide your Social Security number to your ex. This is because your ex can deduct what they pay in alimony from their taxes, lowering their tax bill for the year. Alimony payments (along with your ex’s Social Security number) are marked on Line 31a of the Form 1040. Not reporting your former spouse’s Social Security number may result in a $50 fine, as the IRS uses this information to track payments.

That seems pretty simple, but these are rules from the IRS, so of course it’s not quite as easy as it initially seems. To be considered alimony for taxable purposes, the money in question must be paid subject to a court-approved divorce or separation maintenance decree. According to the IRS, the payments must also meet these guidelines to be considered alimony:

- You and your ex must file separate tax returns and live in separate households

- The payment must be in the form of cash, check, or money order

- The payment must be received by your ex or someone acting on their behalf

- The court order to make the payment cannot state that the payment something other than alimony

- The obligation to make this payment ends when your ex dies

- The payment is not intended as child support or to settle a dispute over property

As long as the payment doesn’t fit into those categories, it is considered alimony for reporting or deduction purposes. In addition, the IRS has repeatedly made it clear that child support and payments from a shared property or payments made to maintain a property are never alimony.

Property awarded to you in the divorce such as a home or car is also never considered alimony, and neither is a payment made for use of your ex’s property. Basically, if it’s not money, it’s not alimony. And if it is money, it must be money given purely for spousal support as directed by the court. If it’s a monetary payment made for any other reason, then it’s not considered alimony under the tax code. Even paying your ex an amount beyond what’s required in the maintenance order isn’t considered alimony.

How Child Support Affects Income Taxes

The IRS has made it abundantly clear that child support is never considered alimony, and there’s a good reason for that: The parent that pays child support can’t deduct it from their taxes, and the parent receiving child support doesn’t have to report it as income. That’s all there is to it. For once, the IRS doesn’t require one of its many numbered forms to document something.

When it comes to kids and taxes, usually the bigger issue is which parent is able to claim the children as dependents. The IRS allows whichever parent provides for at least 50% of a child’s financial needs to claim that child as a dependent.

The IRS presumes that the parent with primary custody will claim the child as a dependent unless the divorce decree states otherwise, or the parent with primary custody signs a Form 8332 allowing the other parent to claim the child as a dependent for that year’s taxes. The noncustodial parent must then submit the Form 8332 with their taxes.

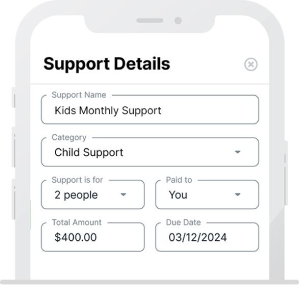

The Importance of Keeping Track of Alimony and Child Support Payments

The IRS is serious about keeping track of alimony and claiming dependents, and any sort of error could raise a red flag that leads to a stressful and time-consuming audit. Keeping track of checks and cash can be a huge hassle, and those documents can even be lost, which is not something you want to have to tell the IRS during an audit. Signing up for a safe, secure online portal like SupportPay means having all of your alimony payments or receipts tracked and easily retrievable when tax time comes.