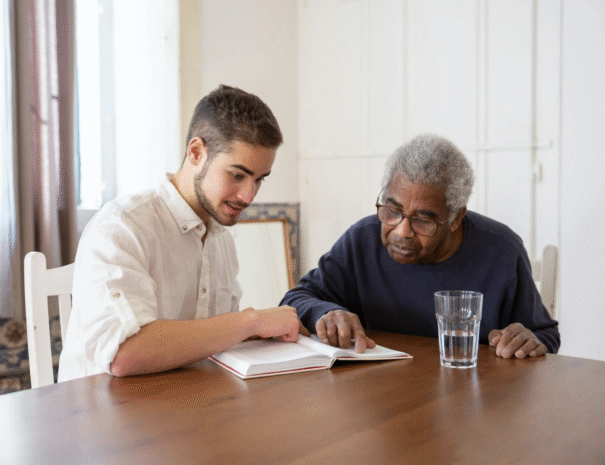

Family caregiving is a selfless act of providing care and support to a loved one who is unable to fully care for themselves. Whether it’s an aging parent, a disabled sibling, or a chronically ill spouse, family caregivers play a vital role in ensuring the well-being and quality of life of their loved ones. While the emotional and physical toll of caregiving is well-recognized, the financial aspect is often overlooked.

The Financial Burden of Caregiving

Caregiving comes at a cost, both in terms of time and money. For many average family caregivers, taking on this role often means sacrificing their careers, reducing work hours, or even leaving their jobs altogether. This loss of income can be a significant blow to their financial stability. Additionally, caregiving expenses can quickly add up, including medical bills, prescription medications, assistive devices, and home modifications to accommodate the needs of the care recipient. These expenses can sometimes exceed the caregiver’s budget, leading to financial strain and increased stress.

Understanding the Financial Sacrifices Made by Average Family Caregivers

Types of Financial Caregiving

Financial caregiving encompasses various aspects, including managing the care recipient’s finances, handling insurance claims, and coordinating healthcare appointments. It also involves budgeting and managing the caregiver’s own financial affairs. The primary caregiver often takes on the responsibility of handling these tasks, which can be overwhelming, especially if they lack financial expertise or experience. They may need to navigate complex systems, such as Medicare or Medicaid, and stay on top of paperwork, bills, and financial planning.

Expenses and Payments Involved in Caregiving

Caregiving expenses can be extensive and varied. From medical costs to transportation expenses, every aspect of the care recipient’s wellbeing requires financial consideration. Prescription medications, medical equipment, and home modifications are just a few examples of the expenses caregivers may encounter. In addition, there may be costs associated with hiring professional help, such as home health aides or respite care providers, to provide temporary relief for the caregiver. These expenses can quickly eat into the caregiver’s budget, often leaving little room for personal needs or savings.

The Impact of Caregiving on the Caregiver’s Finances

The financial sacrifices made by average family caregivers can have a long-lasting impact on their own financial stability. With reduced income and increased expenses, caregivers may find themselves struggling to make ends meet. They may have to dip into savings or rely on credit cards to cover expenses, leading to debt accumulation. Furthermore, the time commitment required for caregiving can limit their ability to pursue additional employment or career advancement opportunities. This can result in a loss of future earning potential and reduced retirement savings, putting the caregiver’s financial future at risk.

Tips for Managing Finances as a Caregiver

Managing finances as a caregiver can be challenging, but there are steps caregivers can take to alleviate some of the financial burdens.

1. Create a Budget and Track Expenses

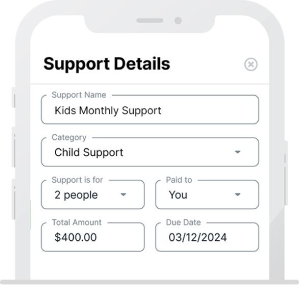

Developing a comprehensive budget can help caregivers get a clear picture of their income and expenses. By tracking every expense, caregivers can identify areas where they can cut costs or find more affordable alternatives. This can include researching generic medication options or exploring financial assistance programs for medical expenses. Using an app like SupportPay can make it easier for family members who share in the expenses keep track of where the budget and expenses are going.

2. Seek Financial Assistance and Support

There are various resources available to provide financial assistance and support for caregivers. Caregiver support groups and non-profit organizations often offer grants or financial aid programs specifically designed to help caregivers. Additionally, government programs like the Family Caregiver Support Program may provide financial assistance or respite care services.

3. Communicate with the Care Recipient’s Healthcare Team

Maintaining open communication with the care recipient’s healthcare team can help caregivers better understand the medical needs and treatment options. This can lead to more informed decisions regarding healthcare expenses and ensure that the care recipient is receiving the most appropriate and cost-effective care.

The Importance of Self-Care for Caregivers

While managing finances is crucial, caregivers must also prioritize their own well-being. Taking care of oneself is essential for maintaining physical and mental health, which directly impacts the ability to provide quality care. Self-care activities can include exercise, relaxation techniques, seeking emotional support from friends or support groups, and setting boundaries to prevent caregiver burnout.

Recognizing and Supporting the Financial Sacrifices of Family Caregivers

Family caregivers make significant financial sacrifices to ensure the well-being of their loved ones. It is essential to recognize the financial burden they shoulder and provide support systems to alleviate some of the challenges they face. By understanding the types of financial caregiving, managing expenses, and implementing practical strategies for financial stability, caregivers can navigate their caregiving journey with greater ease. It is crucial for society, policymakers, and healthcare professionals to acknowledge and address the financial sacrifices made by average family caregivers, ensuring they receive the recognition, support, and resources they deserve.