Written By: Ronnie Foutz

According to the law, both parents must support their children financially. In most cases, the non-custodial parent will make child support payments to the custodial parent. But when it comes to accounting for child support spending, things can get a bit tricky.

There is no legal requirement for the custodial parent to provide an accounting of how child support payments are spent. However, some parents choose to do so anyway, either to be transparent or avoid any potential conflict.

If you are a custodial parent and are thinking about demanding an accounting of child support payments, you should keep a few things in mind.

What is an Accounting of Child Support?

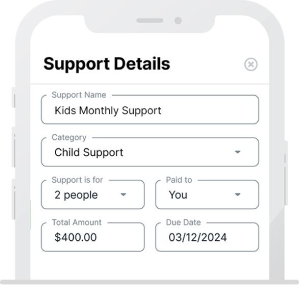

Child support is a payment from a non-custodial parent to the custodial parent for their child’s financial support and care. It is not just about money – it covers healthcare, education, and extra-curricular activities.

An accounting of child support is simply an account of how much money was received and how it was used to benefit the child or children.

It can also include any changes to the child support agreement, such as increases or decreases in payments. While child support can sometimes be a contentious issue between parents, it is about ensuring that a child’s needs are met and that they have the resources they need to thrive.

Parents with a lack of experience in accounting are choosing the help of an accounting firm that has experience in dealing with the relevant authorities and child support cases and can ensure that the process is completed correctly and without unnecessary tension between co-parents. Some firms also offer a free initial consultation to assess your situation and advise you on the

best course of action.

This can give you peace of mind and allow you to focus on your child or children.

But is Accounting for Child Support Mandatory in every State?

No, every state has different laws regarding child support. For example, some states require that both parents share information about how child support payments are spent, while other states do not have this requirement.

Some states have centralized systems, while others rely on individuals or agencies to track and report payments. Some states also have strict enforcement mechanisms in place, with consequences for failure to make required child support payments.

Washington State, for example, has a Parental Accountability Act which requires both parents to “account for all expenses incurred on behalf of the child.” This law also requires that any disputes about how the money is spent must be resolved through mediation.

In contrast, Arizona does not have a law mandating parents account for how child support payments are spent. However, the state does require that both parents share information about their income and assets, as well as any debts they may have.

If you live in a state where accounting for child support is not mandatory, you may still choose to request this information from the non-custodial parent. However, they are not legally obligated to provide it to you.

In this case, the best is to consult a family lawyer or accounting firm who can help you keep track of the payments and ensure that they are being used for the benefit of your child.

Who has the Right to Demand an Accounting of Child Support?

Generally speaking, any parent receiving child support payments has the right to request an accounting of how those payments are being spent.

However, there may be some circumstances in which the non-custodial parent (the parent making the payments) may also have the right to request an accounting.

For example, suppose the non-custodial parent suspects that the custodial parent is not using the child support payments for their intended purpose. In that case, they may request an accountant to confirm their suspicions.

What are the Consequences?

If you are a non-custodial parent and are ordered to provide an accounting of child support payments, failure to do so may result in wage garnishment, seizure of assets, or even jail time.

It is essential to keep accurate records and receipts for all payments made. In addition, it would help if you kept any correspondence between yourself and the custodial parent or state agency regarding payment amounts and dates.

While many parents handle child support payments, several agencies and organizations can help with this process.

If you are having difficulty collecting child support payments, consider hiring an accounting firm that understands your rights and options and may be able to help you manage the amounts you are owed and make a clean start on your co-parenting.

The experts of an accounting firm can help you understand your rights and options when it comes to demanding or requesting an accounting of child support payments and can help you accomplish what is best for your little one.

About the Author:

Ronnie Foutz is a Certified Public Accountant in the state of California. Ronnie has over 20 years of experience providing financial consulting services to small businesses and individuals. Ronnie has a passion for helping others achieve their financial goals, and he uses his expertise to provide clients with guidance and support every step of the way.