Older Adults

Caring for an Older Adult Shouldn’t Mean Fighting Over Money

Coordinate elder care costs with siblings and caregivers—without the stress, confusion, or resentment.

The Hidden Stress of

Elder Care Finances

Caring for an aging parent is already hard. Managing the finances behind it shouldn’t be harder. But it often is—especially when the burden is shared.

From monthly facility bills to prescriptions, groceries, and out-of-pocket medical expenses, families are left juggling spreadsheets, texts, and payment apps with no clear system in place. The result? Miscommunication, financial tension, and emotional burnout.

You’re not alone—over 90% of adults struggle with managing shared family finances, especially when caregiving is involved.

Financial Caregiving Is Broken

- No shared system to split, track, and manage expenses fairly

- Constant “Who paid what?” confusion among siblings and caregivers

- No visibility into bank accounts or spending (and no way to share info safely)

- Disagreements over how money is being used

- Missing documentation for taxes, estate planning, or power of attorney

Traditional budgeting tools and payment apps weren’t built for elder care. SupportPay is.

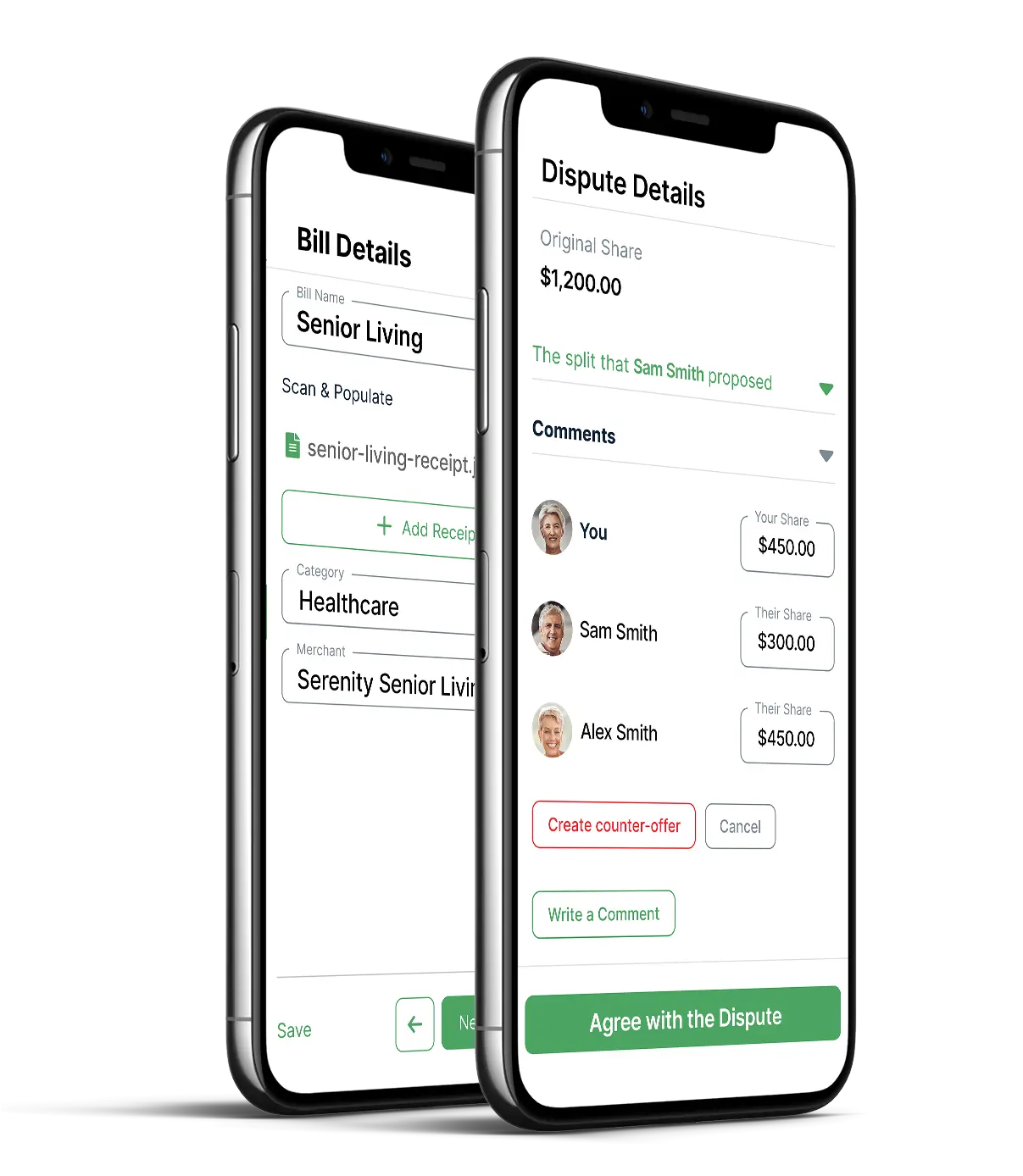

SupportPay: The Modern Way to Manage Elder Care Costs

We’re pioneering a new category: Modern Family Finances—giving caregivers the tools to transparently, securely, and efficiently manage shared financial responsibilities.

We’re pioneering a new category: Modern Family Finances—giving caregivers the tools to transparently, securely, and efficiently manage shared financial responsibilities.

With SupportPay, you can:

- Split and track expenses like medical bills, home care, groceries, prescriptions, or utilities

- Share financial information without sharing account access—see balances and spending in real-time

- Reimburse family members or pay the care provider directly

- Store receipts, invoices, and documents as certified legal records

- Automate payment reminders, alerts, and communication—eliminating emotional back-and-forth

- Set privacy preferences to control what you share and with whom

- Access all records for estate, tax, court, or Power of Attorney needs

Whether you’re the “finance person” in the family or just trying to help from a distance, SupportPay makes caregiving collaboration simple and secure.

Why Families Trust SupportPay

Used in 70+ countries

500k+ lives impacted

$800M+ managed transactions

94% improved relationships

83% time savings each week

Credit boost for timely payments

The Future of Family Financial Wellness Is Here

Caring for your aging parents is already hard enough. SupportPay gives you the structure, clarity, and peace of mind to stop the stress—and focus on what really matters.

It’s not just a budgeting tool.

It’s a caregiving coordination platform.

It’s not just financial wellness.

It’s family financial wellness.

Request a Demo

On the fence? Request a quick demo to explore how SupportPay simplifies family loans, support requests, and repayment—so you can decide with confidence.

Other Groups We Serve

Divorcees

Navigating financial commitments post-divorce can be difficult. SupportPay provides a transparent and structured way to manage shared expenses, eliminating the need for stressful conversations.

Elder Care

Supporting aging parents comes with emotional and financial responsibilities. SupportPay helps families manage medical expenses, caregiving costs, and shared contributions with full transparency and ease.

Single Parents

Juggling finances and co-parenting alone is challenging. SupportPay simplifies managing shared expenses, ensuring financial obligations are met while reducing tension and improving communication.